- Article

- Sustainability

- Transition to Net Zero

- Sustainable Financing

How is AMG helping the battery industry cut its carbon footprint?

The industrial materials sector faces a long journey towards net zero emissions. With HSBC’s support, AMG is investing in circular processes and energy efficiency to reduce its environmental impact.

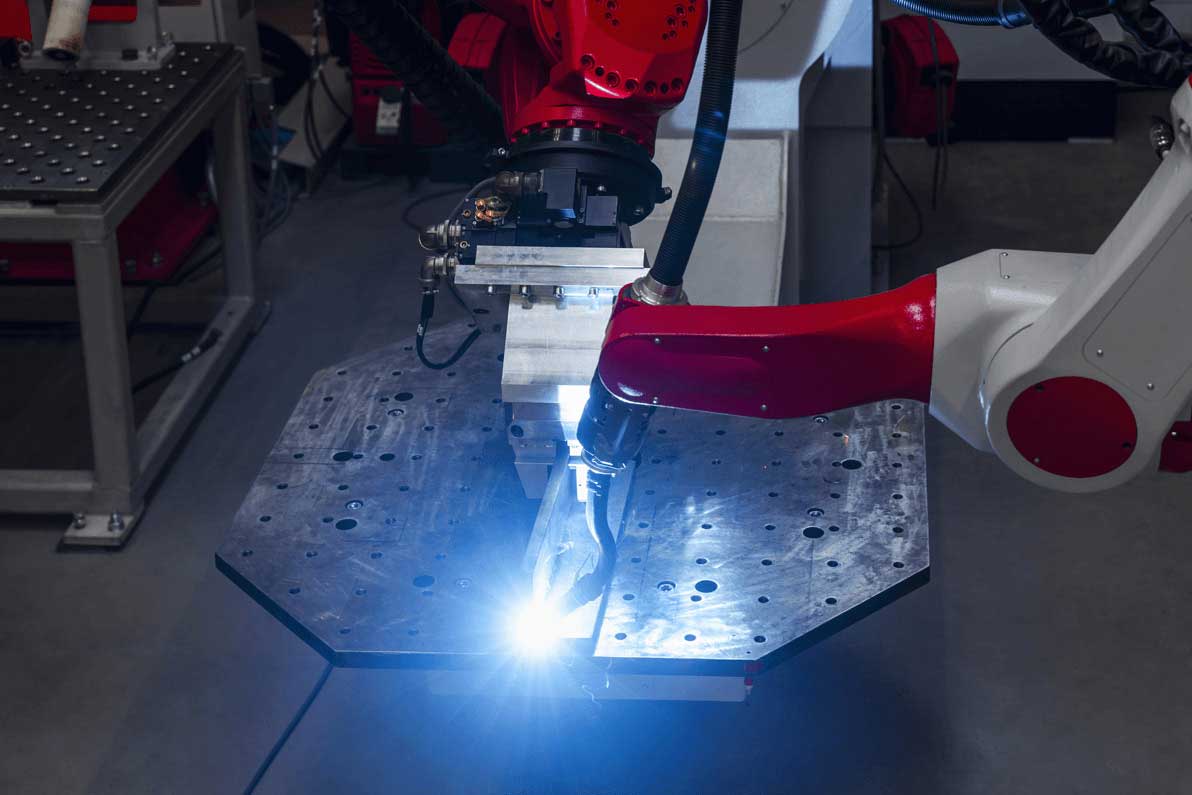

AMG produces a number of materials that are critical to the energy transition, including lithium and vanadium for the battery industry. As well as enabling these low-carbon technologies, the company is working to reduce the environmental impact of the materials it produces – notably by replacing primary extraction with recovery and recycling – and help its clients cut back on their own CO2 emissions.

HSBC supported AMG’s first foray into sustainable financing in November 2021, when the company embedded sustainability targets into a USD$200 million revolving credit facility.

Dr. Heinz Schimmelbusch, AMG’s Founder, Chief Executive Officer and Chairman, and Dan Chila, the company’s Treasurer, discuss decarbonisation, energy efficiency and the role of green finance.

Q: How important is decarbonisation to AMG?

Dr. Heinz Schimmelbusch: We have long-term targets for reducing both direct CO2 emissions and those generated over the entire lifecycle of the materials we produce.

We aim to cut our scope 1 and 2 carbon emissions – those produced by AMG’s own operations and energy usage, respectively – by 20% by 2030 from a baseline of 625,000 metric tonnes.

But it is in so-called ‘avoided emissions’ where we have the greatest opportunity to make an impact. Our materials help our clients transition away from fossil fuels and improve their energy efficiency, and we have committed to increase this ‘enabled’ CO2 reduction by 10% each year until 2030. For example, our new vanadium recycling facility in Ohio in the US uses waste products from oil refineries and power plants rather than primary resources from mining.

The concept of avoided emissions is often referred to as scope 4, as it sits beyond the traditional three scopes of emissions set out by the Greenhouse Gas Protocol. At AMG, we call this new way of calculating emissions our Enabled CO2 Reduction Portfolio, or ECO2RP. We think it’s a really important metric.

Commitment | Baseline | 2022 | 2030 Target | Status |

|---|---|---|---|---|

Reduce direct CO2 emissions by 20% by 2030 | 625,000 mt | -26% | 125,000 mt (-20%) | on track |

Increase enable CO2 by 10% per year | 79 million mt | +25% | 10% per year | on track |

Q: Is there a commercial advantage in being a low-carbon supplier of industrial materials?

Schimmelbusch: Yes. The product lines that contribute to our clients’ carbon reduction are more profitable and grow faster than the other AMG product lines, and we expect this to continue as emissions reporting gains momentum. An example is the thermal barrier coating we apply to jet engine turbine blades that allows them to operate at higher temperatures, which makes the engines more efficient.

The use of our materials in 2022 enabled our clients to avoid 99 million metric tonnes of CO2 emissions, the equivalent of a year’s output from 26 coal-fired power plants. That figure is up from 79 million metric tonnes in 2021, and we expect this will continue to rise as our battery-related businesses and energy-efficient products expand.

Q: What initiatives have been most effective for reducing your scope 1 and 2 emissions?

Schimmelbusch: In general, our greatest gains across AMG have been through operating efficiencies and energy sourcing. Our primary focus today is to target our remaining largest scope 1 and 2 contributors – silicon and vanadium – by making improvements to combat energy intensity. Specifically, we are looking to use more renewable energy and battery solutions to meet our energy needs.

Q: AMG recently launched its first hybrid energy storage system. How does it work and how important is the scaling of new technologies like this?

Schimmelbusch: It is a stationary electricity storage system consisting of a lithium battery and a vanadium redox flow battery, managed by artificial intelligence software.

We developed the LIVA system for industrial and grid management applications, to use to reduce costs at times of high electricity prices instead of taking power supply from the grid. This is known as ‘peak shaving’. However, a vanadium battery cannot handle instantaneous electricity demand, so it made sense to combine it with a lithium battery, which allows for fast discharge.

We are installing LIVA batteries at five of our sites and for external customers with a combined size of tens of megawatt hours. Scaling the technology is key because the demand for such solutions is increasing.

Q: How have you aligned your financing with your sustainability strategy?

Dan Chila: We have watched the ‘green’ corporate financing space evolve over several years and we always sought, under the right circumstances, to include an ESG feature in our financings to align AMG better with our investors’ interests.

The refinancing of our USD$350 million term loan and US$200 million revolving credit facility in November 2021 provided the perfect opportunity to embed key performance indicators [KPIs] on sustainability objectives. These KPIs are ambitious and, if achieved, will result in interest rate reductions, enhancing shareholder returns and building value.

Within the revolving credit facility, we developed a KPI framework aligned with internationally recognised principles. We receive a 5 basis point [bps] interest rate reduction if we meet both KPIs for the year and a 5bps penalty if we miss both. In November 2021, we set annual targets for each KPI for the next five years.

The first of the two KPIs is focused on the reduction of CO2 emissions through growing investments in renewable energy for our lithium and vanadium businesses and increased production of products with a smaller carbon footprint. The second KPI focuses on enabling more carbon reduction for clients.

We thought this was the best structure to use as our entry into the sustainable financing space. The targets were simple, yet material and ambitious, and we could easily incorporate the structure into our loan agreements. Furthermore, AMG already had the internal processes in place to gather the KPI data we needed.

We exceeded our 2021 and 2022 goals for both KPIs and achieved a 5bps interest rate reduction on our revolver in both years. Our external auditor, KPMG, reviews the calculations and our performance against the goals.

Q: What kind of banking support have you found helpful and what are your expectations for the future?

Chila: AMG has found it helpful to have sustainability-focused expert banking partners to give insight on market changes and investors’ views and provide new ESG financing ideas and products.

As the capital markets continue to evolve in this space, we look forward to using more sustainability-focused financing and banking products, such as sustainability-linked time deposits and money market funds, and green bonds.

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. Find out more: https://www.hsbc.com/who-we-are/our-climate-strategy