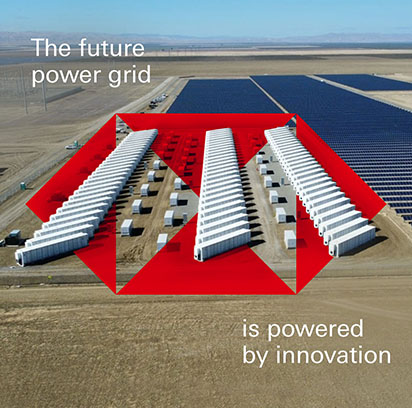

Generation and consumption of energy will both see significant changes in the coming years. We’re excited to support climate tech companies as they develop and commercialize the technologies that will increase access to reliable, clean energy.

|

Here’s how some of our high growth clients innovating in the Climate Tech space and driving this agenda forward, and why we’re invested in the work that they do.