- Article

- Innovation & Transformation

- Covid-19

Market risk management: What treasurers need to consider during COVID-19

Corporate treasurers considering COVID-19 hedging strategies are facing a complex set of challenges.

A version of the following article originally appeared in the Luxembourg Association of Corporate Treasurer's Treasurer Magazine - Issue #104

There is no bigger focus for corporate treasurers these days than managing the impact of COVID-19 on their organization. And while cash is likely to be king for most companies currently, both their current hedge book and future strategy to manage market risks have risen in importance as well, explains Holger Zeuner, Head of Thought Leadership EMEA within HSBC’s Global Markets Corporate Sales team.

What makes hedging so difficult in the current environment?

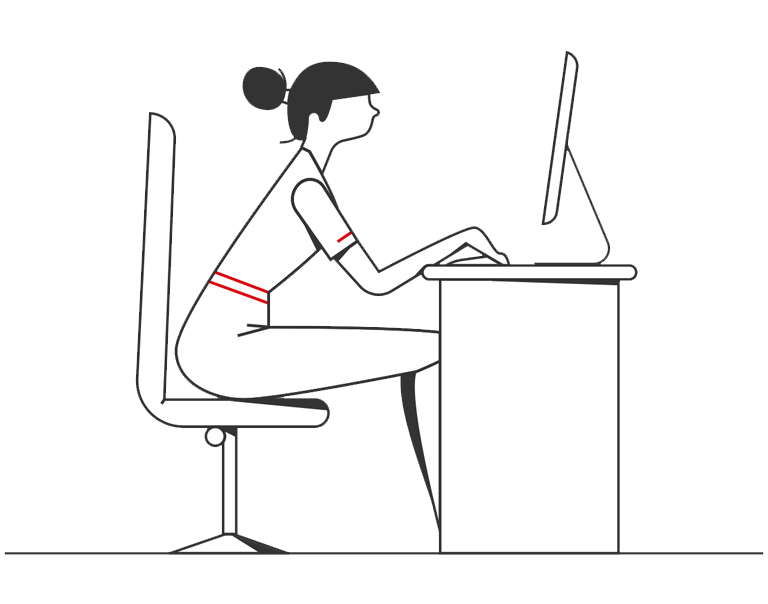

There are four factors coming together on this: first, the economic outlook for businesses has become highly uncertain, making the volumes and maturities of hedges that we saw before the pandemic less applicable in today’s climate. Second, market volatility has come back with a vengeance to many currency pairs, commodity prices and interest rates. Third, with remote working as the status quo for most corporate treasurers, there is a potential increase in operational risk in executing the chosen strategy while being away from the usual office set-up. And finally, this has been met by reduced market liquidity.

“All of these factors taken together significantly complicate corporate decision-making,” according to Zeuner. Higher volatility indicates an increased risk environment (particularly when measured against traditional risk measures such as value-at-risk or historic scenarios) – usually indicating a requirement to hedge more. When this meets a reduced certainty on underlying cash flows, treasurers are faced with a challenging hedge decision.

A solution to that is more frequent communication with all internal stakeholders and bank partners to understand the current extraordinary dynamics of sales orders, supply chains and market liquidity.

Some perfect storms have already arrived

But new hedge decisions are not the only source causing headaches for risk managers these days. In some situations, so-called wrong-way risk has occurred on existing hedges, spilling over into liquidity planning and impacting financial statements.

“This has happened when underlying cash flows, which have been hedged, are no longer likely to materialize, and the FX move has led to a negative ‘mark-to-market’ of the derivative,” explains the HSBC expert. As examples, he cites European corporates that had hedged dollar revenues or emerging market cost bases in Mexican Peso or Polish Zloty. If such underlying cash flows are falling away, designated hedge accounting relationships could break and require the derivative value to be realized as a loss.

Engaging with subject matter experts is helpful when navigating these issues as it is key to understand the nuances in the application of accounting rules when determining if there is indeed a missed forecast (the hedge cash flow does not materialize) versus being over-hedged. This could cause further stress not only on financial results but also corporate cash when the hedge is due for settlement. In the direr cases it could also impact the ability for additional credit being available from bank counterparties.

Setting sights ahead – a crisis as catalyst for change

For those who have successfully avoided or already tackled these issues, it’s worth thinking ahead: how will any ‘new normal’ future of your business impact your risk management needs? It won’t be decided tomorrow, but once financial stability and funding is secured, a critical review of your treasury policy should be undertaken.

The HSBC banker sees three potential trends to prevail from this. First, the focus of technology investments will be even more on those with immediate benefit – e.g., ability to collect and process payments online being on top of many lists. Second will be to add flexibility to the instruments and hedge ratios defined in the treasury policy. For those impacted by wrong-way risk, they may look more intensively into FX options: “We had seen an uptick in option-based solutions already when Brexit was the main concern for many companies. But the current business uncertainty is far more widespread, and options have proven to become an asset in a liquidity stress situation,” says Zeuner. This continues a trend of corporates looking at more structured hedge solutions in the wake of changes to hedge accounting rules.

Finally, he expects more companies to increase the weight of regional treasury centers in managing risks. As long as the virus risk overhangs global trade and supply chains, more local solutions can ensure operational readiness and the ability to react quickly. Having a strong global bank partner at your side who understands and follows such organizational decisions, will help companies on this journey.